If you're venturing into the whole world of homeownership for The very first time, you will discover that comprehension your funds is surely an indispensable initial step. It isn't really nearly exactly how much you are able to borrow; it's also about recognizing That which you can easily afford to pay for without having stretching on your own much too slender. This equilibrium is essential, as it impacts your capability to check out different home loan choices efficiently. But How does one figure out what that harmony seems like, and what are the concealed costs that would capture you off guard? Let's explore what it takes to help make a monetarily seem selection in your journey toward acquiring your very first property.

Prior to diving into the home-looking system, you'll want to grasp your money predicament comprehensively. Commence by evaluating your recent profits, price savings, and charges to find out the amount you can afford to invest on a whole new residence with out overstretching.

It is important to contemplate not only the acquisition price tag but additionally ongoing fees like property taxes, homeowners insurance policy, and routine maintenance.

You will need to assessment your credit score likewise, as it considerably influences mortgage phrases made available for you. In case your rating is low, it is advisable to shell out a while enhancing it to safe better rates.

When you comprehend your economical health and fitness, it is time to examine property finance loan solutions that accommodate your spending plan and homeownership aims.

You will discover various types to choose from, such as fixed-price, adjustable-price, and authorities-backed loans like FHA, VA, or USDA. Each kind has distinctive benefits and disadvantages.

Fastened-charge mortgages give security with steady month-to-month payments, while adjustable-fee mortgages may possibly start with lessen prices but can improve after some time.

Authorities-backed options might be attractive if you're looking for lessen down payments or have particular requires like becoming a veteran.

It can be essential to check premiums, conditions, and total charges from various lenders to make sure you get the very best deal.

Will not rush; just take your time and energy to understand Each and every selection totally.

Just after Discovering home finance loan selections, it's time to change your concentration to finding the ideal home.

Start by listing what you need: range of bedrooms, lawn space, and proximity to operate or schools. Contemplate your Life style and future plans. Do you want a home office? Place to get a rising loved ones?

Next, analysis neighborhoods. Look for regions that match your safety, advantage, and aesthetic preferences.

Remember to take a look at neighborhood features like parks, shops, and dining places.

Retain the services of a reputable real-estate agent who knows the realm very well. They can offer invaluable assistance, from determining households that meet your requirements to navigating household excursions.

Now that you have discovered your excellent property, it's time to make a proposal. This pivotal phase consists of various critical elements.

First, identify your Preliminary bid. Consider the household's market place value, your finances, and simply how much you certainly want the home. It is really sensible to refer to with your real-estate agent to strategize according houses for sale in st adele quebec to recent sector trends.

Up coming, put together a formal present letter. This doc should really contain your proposed price tag, wished-for closing day, and any contingencies, which include passing a house inspection or securing financing.

Be All set to barter; sellers could possibly counter your offer, demanding you to determine regardless of whether to meet their phrases, revise your bid, or stroll away. Creating a wise provide sets the phase for An effective buy.

Closing the offer in your new home can sense like a marathon's ultimate sprint. You are just about within the finish line, but a couple of vital actions stay.

Initial, you are going to overview and signal a stack of legal files, which lawfully transfer ownership to you. It's crucial you have an understanding of these papers, so You should not be reluctant to question your real estate property agent or attorney to clarify anything at all complicated.

Up coming, you'll need to take care of the closing expenditures, which generally range from two% to 5% of the house's acquire value. These consist of fees for financial loan processing, title insurance plan, and a lot more.

Be sure you've budgeted for these expenses.

Buying a dwelling can originally fall your credit score due to the really hard inquiry and new debt.

On the other hand, producing dependable home finance loan payments can increase your score over time.

It is really a major monetary dedication.

You should buy a house following a recent task change, but lenders may possibly review your employment balance and profits continuity to make sure you can fulfill your mortgage loan obligations continually.

You should contemplate buying a property warranty, as it might protect unanticipated maintenance costs, which could help you save you revenue and cut down worry if important appliances or devices break down right after your buy.

Purchasing a household impacts your taxes; you'll likely get deductions on property finance loan fascination and home taxes.

However, It is really advanced, and Rewards vary, so look at consulting a tax Skilled To optimize your benefits.

Residence taxes can boost on a yearly basis, according to area authorities assessments and finances requirements.

You'll see alterations dependant on house benefit reassessments or shifts in municipal funding requirements.

It is essential to price range for likely increases.

Remember to overview your funds carefully, investigate all home finance loan choices offered, and go with a dwelling that matches equally your requirements and funds. Make your give confidently but sensibly, keeping long term expenses in mind. Ultimately, when closing the deal, guarantee all the required checks and paperwork are dealt with meticulously. By adhering to this guidebook, you might be location you up for An effective and fulfilling household-purchasing journey. Welcome residence!

Kelly McGillis Then & Now!

Kelly McGillis Then & Now! Michael Bower Then & Now!

Michael Bower Then & Now! Judge Reinhold Then & Now!

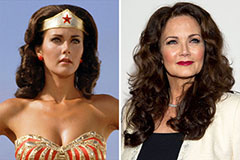

Judge Reinhold Then & Now! Lynda Carter Then & Now!

Lynda Carter Then & Now! Sarah Michelle Gellar Then & Now!

Sarah Michelle Gellar Then & Now!